2024 Home Office Deduction Schedule C – You must have some Schedule C income from self-employment to be eligible for the home office deduction. Does Your Home Office Qualify for the Tax Break? Your home office must meet certain . The Internal Revenue Service (IRS) has just released the updated income tax brackets for 2024, enabling individuals .

2024 Home Office Deduction Schedule C

Source : thecollegeinvestor.com

The Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Tax advice for clients who day trade stocks Journal of Accountancy

Source : www.journalofaccountancy.com

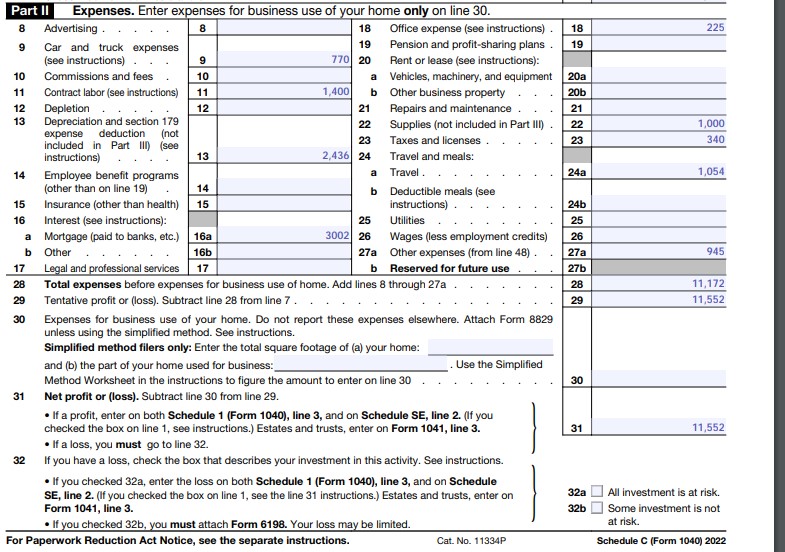

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Dublin Nissan Bay Area Nissan Dealer Near Hayward, San Leandro

Source : www.dublinnissan.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

TurboTax® Home & Business Desktop 2023 2024 | Personal & Small

Source : turbotax.intuit.com

Recreational Cannabis Businesses

Source : www.nj.gov

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

2024 Home Office Deduction Schedule C When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024: If you plan your investments across different financial assets such as PPF, NSC, ELSS, etc., you can claim deductions of up to Rs.1.5 lakh under Section 80C, thereby lowering your tax liability. Union . Additionally, the IRS adjusted its standard deduction for 2024. That allows for households to deduct more of their expenses from qualified deductions (such as mortgage insurance, charitable .